FHA Loan Guide

What is a FHA Loan?

An FHA Loan is a mortgage that’s insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as 3.5% and are especially popular with first-time homebuyers.

Who can qualify for a FHA Loan?

FHA Loan are often a popular choice for a first-time homebuyer. FHA loans require a lesser deposit than a conventional loan and can help keep costs low when purchasing a home.

What are the requirements?

- FICO® score at least 580= 3.5% down payment.

- MIP (Mortgage Insurance Premium) is required.

- Debt-to-Income Ratio < 43%.

- The home must be the borrower’s primary residence.

- Borrower must have steady income and proof of employment.

What are the requirements?

How to Save for the 3.5% FHA Loan Down Payment

One of the biggest hurdles homebuyers face is saving for a down payment. As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there. The process may actually move faster than you think.

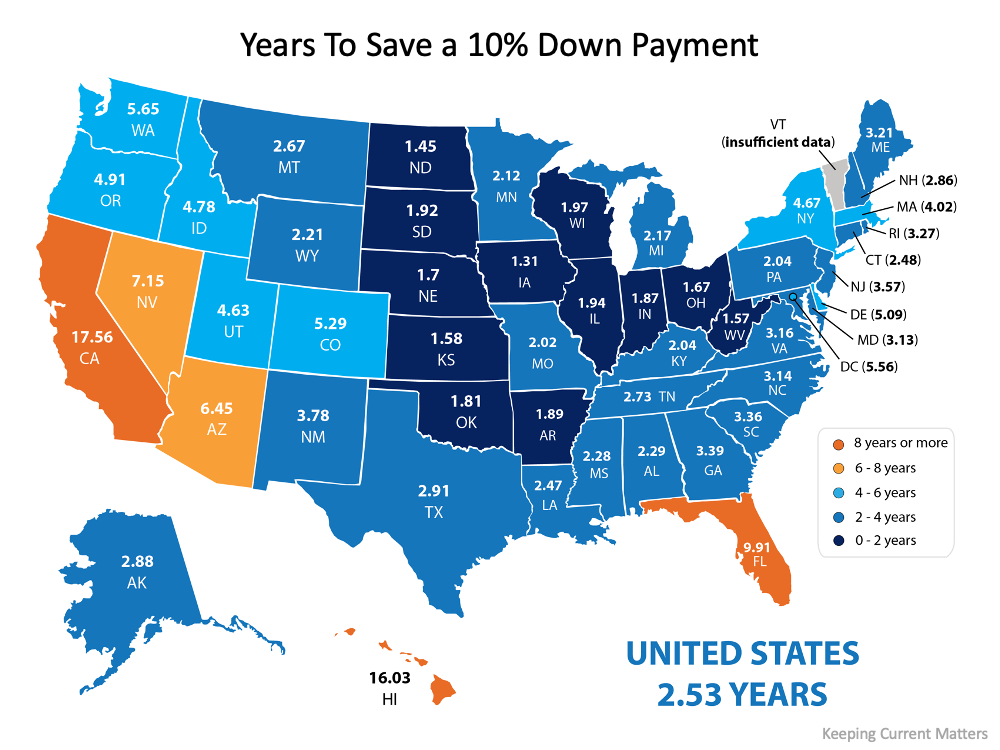

Using data from the U.S. Department of Housing and Urban Development (HUD) and Apartment List, we can estimate how long it might take someone earning the median income and paying the median rent to save up for a down payment on a median-priced home. Since saving for a down payment can be a great time to practice budgeting for housing costs, this estimate also uses the concept that a household should not pay more than 28% of their total income on monthly housing expenses.

According to the data, the national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53). Residents in Iowa can save for a down payment the fastest, doing so in just over one year (1.31). The map below illustrates this time (in years) for each state:

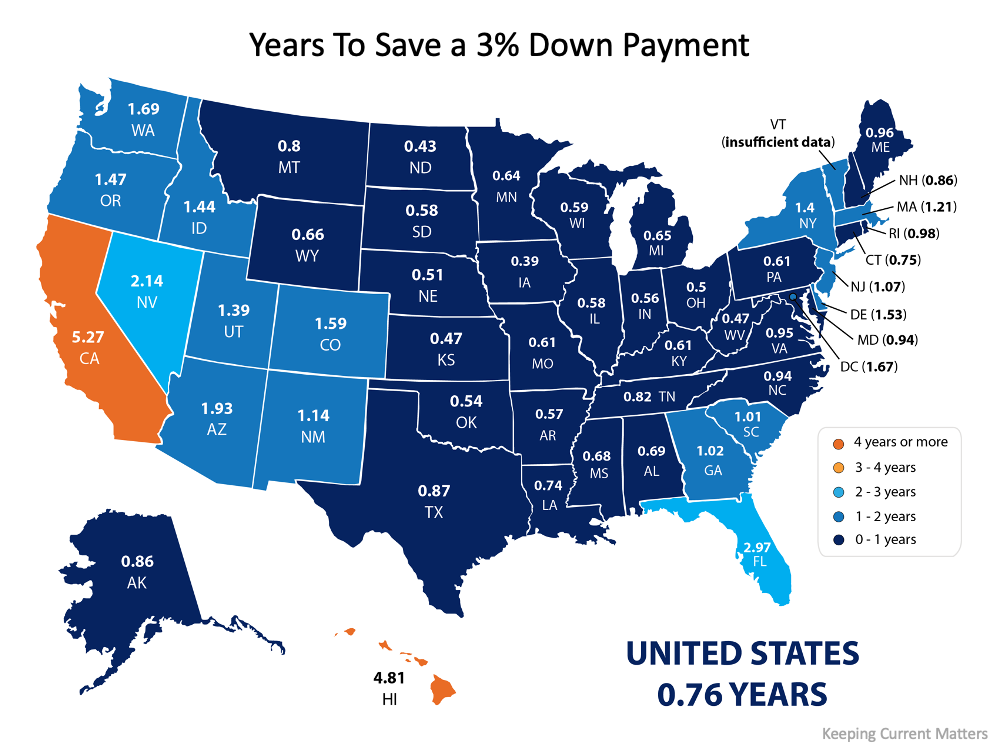

What if you only need to save 3%?

What if you’re able to take advantage of one of the 3% down payment programs available? It’s a common misconception that you need a 20% down payment to buy a home, but there are actually more affordable options and down payment assistance programs available, especially for first-time homebuyers. The reality is, saving for a 3% down payment may not take several years. In fact, it could take less than a year in most states, as shown in the map below:

Saving For Your Down Payment:

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Let’s connect to explore the down payment options available in our area and how they support your plans.